The Anti-Hype Metric: Why Constellation Software Understates Its Own Success

A primer on Constellation Software's internal profit metric FCFA2S and the surprising reason why it is controversial.

For value investors, few things are as satisfying as finding a company that generates a mountain of cash. But figuring out exactly how large that mountain is can be tricky, especially when a company uses its own custom measuring stick.

This is the case with Constellation Software and its internal metric: FCFA2S (Free Cash Flow Available to Shareholders). To value this stock correctly, you have to understand what this number is, why it’s controversial, and specifically, how you should treat a mysterious line item called the "IRGA" liability.

The "Internal Metric" Dilemma

FCFA2S is Constellation’s version of "true profit." In spirit, it is like when other companies present EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) or "Adjusted EBITDA." The goal is usually to strip away accounting distortions to show investors the actual cash the business generates.

However, seasoned investors are naturally skeptical of custom metrics. Often, management teams use these adjustments to paint a rosier picture, adding back real expenses (like stock-based compensation) to make the company look more profitable than it is. Therefore, the golden rule of value investing is to review every single add-back or subtraction. Does this adjustment help reveal the truth, or is it hiding a cost?

In Constellation’s case, the debate is fascinating because they use an adjustment that make their results look worse, not better.

Understanding the Metric

Constellation defines its goal clearly. As stated in their filings:

"We believe that FCFA2S is useful supplemental information as it provides an indication of the uncommitted cash flow that is available to shareholders if we do not make any acquisitions, or investments, and do not repay any debts. While we could use the FCFA2S to pay dividends or repurchase shares, our objective is to invest all of our FCFA2S in acquisitions which meet our hurdle rate."

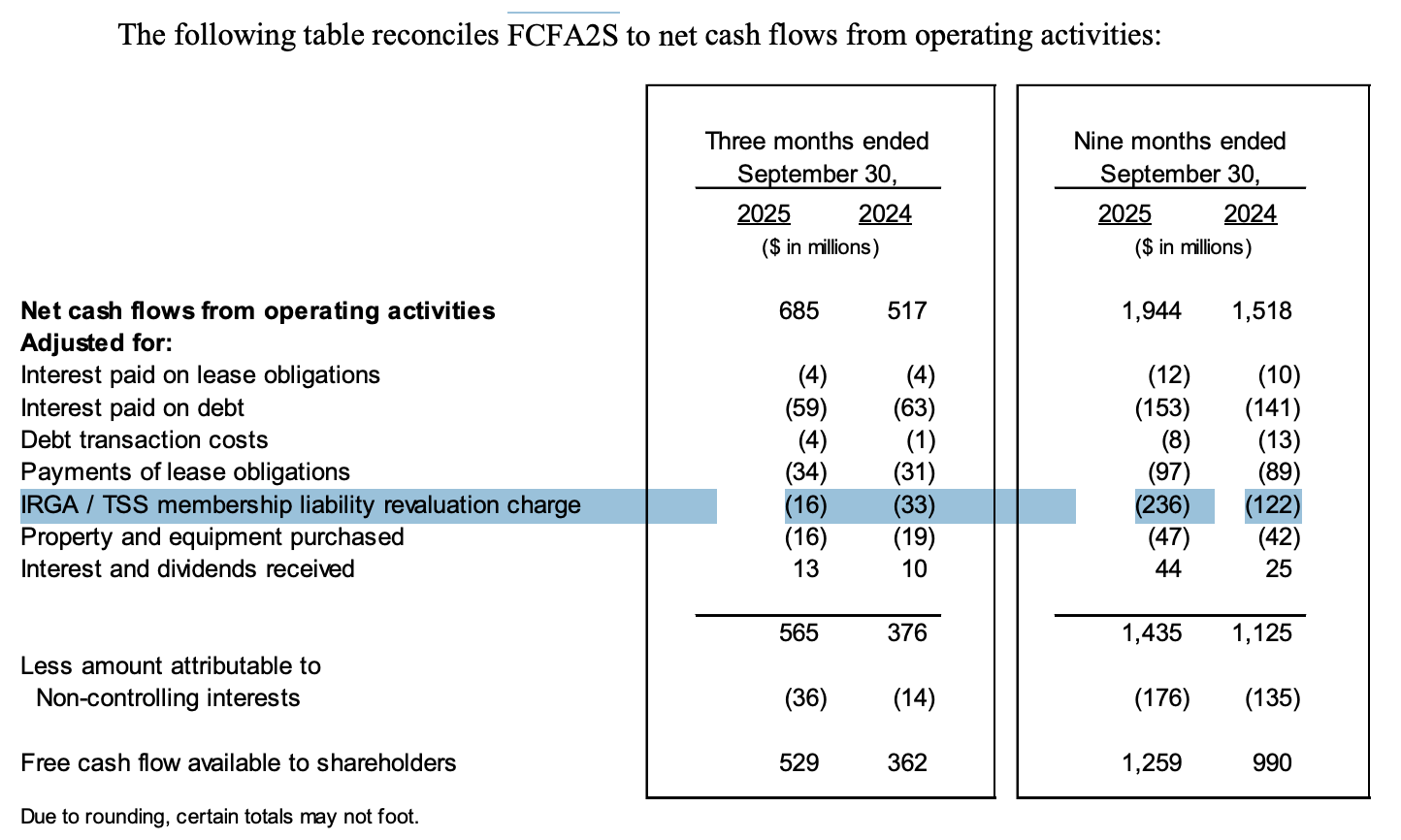

Practically speaking, to get to this number, Constellation starts with Net Cash Flows from Operating Activities from the GAAP cash flow statement. They then subtract interest payments, lease obligations, and capital expenditures (CAPEX) to find the true free cash flow. Finally, they subtract the IRGA liability revaluation—a specific accounting charge that accounts for payouts to minority partners in their subsidiaries.

Here’s a clip of the FCFA2S from Constellation’s Q3 2025 Shareholder's Report

We’ll explain why the IRGA liability line is highlighted momentarily.

Why Constellation Uses This Formula

Constellation uses this strict formula because they view the company primarily as a reinvestment machine. This means that instead of paying out profits to shareholders as dividends, the company’s core strategy is to take every available dollar of cash flow and use it to acquire more software businesses to compound value over time.

While standard accounting metrics show what the business "earned" on paper, their FCFA2S metric identifies their uncommitted cash flow—the actual surplus generated during the reported period that isn't already promised to lenders, landlords, or partners. By stripping away these obligations, management can see exactly how much capital they have at their disposal to fund new acquisitions. Essentially, it measures the company's ability to grow without needing to take on new debt or issue more shares.

One little problem…

First a little background on Constellation Software’s deals, when Constellation buys large businesses, they don't always buy 100% at once. Instead, they might buy 70% or 80%, allowing the original founders or managers to keep the remaining "minority stake" so they stay motivated to grow the business.

As part of these deals the company Constellation bought has the right to force Constellation to buy their remaining 20% or 30%, and Constellation has the right to force them to sell their remaining 20% - 30% to Constellation.

Either way, Constellation will eventually buy out and own the entire company.

Remember we highlighted the line item “the IRGA / TSS membership liability” in the quarterly filing screenshot? We'll just refer to it as the IRGA liability from here on out, is the estimated amount of money Constellation will eventually have to pay for the remaining 20% - 30% of a large business they purchased.

Is the payout 100% certain? Yes, but importantly it might not happen (literally) for decades. This is specifically why FCFA2S is controversial. By subtracting the cost from FCFA2S today, Constellation ensures they never feel richer than they actually are, keeping the company disciplined and ready for the day the bill finally arrives. That sounds good to them, but many investors feel strongly otherwise.

The adjustment

In accounting terms, that money Constellation sets aside as the IRGA liability to buy out the rest of the large business is a "liability" (a debt they owe). But in reality, is it a loss? Not really. It is money earmarked to buy more of something that is sure to be valuable.

Therefore, knowing they will spend the money and gain something of value in the future, it logically just doesn’t make sense to view that money as zero today (or ever).

That is why many savvy investors disagree with the IRGA liability subtraction. Their argument is: "Wait a minute. This money is being used to acquire more ownership in profitable subsidiaries. That is growth capital, not a maintenance expense."

These investors believe you should add back the IRGA line item to get a true picture of the company's generating power. Many also tend to criticize Constellation Software for subtracting it in the first place.

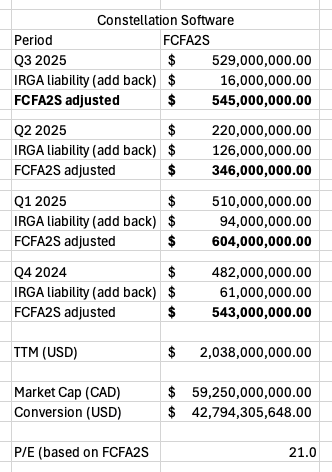

That is exactly why many investors who monitor Constellation’s price multiple use the adjustment of adding the IRGA liability back into the calculation.

Who’s right? Well, why not calculate BOTH

It doesn’t take very long to calculate the adjustment. FCFA2S is already listed in each filing, so the only adjustment you would need would be to add back the IRGA liability line item and you could consider both metrics, FCFA2S and the adjusted version.

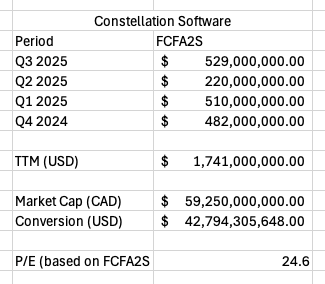

Calculations below are as of market close on January 19th, 2026. Keep in mind market caps constantly change.

1. The Conservative Multiple: Take the FCFA2S figure directly from the company filing (where IRGA is already subtracted). Divide the market cap by this number. This gives you a conservative valuation, treating those future buyouts as a pure cost.

2. The Growth Multiple: Take the FCFA2S figure and add back the value listed under "IRGA" or similar liability payments in the cash flow statement. Divide the market cap by this new, larger number. This usually results in a lower multiple, making the stock look more attractive.

The Verdict Is Yours

There is no single "correct" answer, only the one that aligns with your investment philosophy.

- If you prefer extreme safety, stick with the company’s conservative number. If the stock looks cheap even after subtracting IRGA, it’s a very strong signal.

- If you view buying out minority partners as a strategic investment that builds value—just like buying a new company—you should add it back.

By understanding the mechanics of FCFA2S and IRGA, you move from passively reading a financial statement to actively analyzing the business.